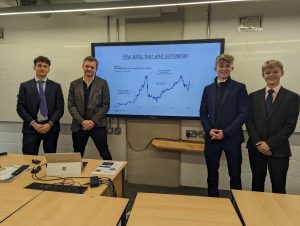

In Economics and Business society Daniel Read, an investment banker, came in to talk to us about his line of work. We were informed by him how investment banking heavily relied on understanding the human side of economics. This is due to an investment banker needing to know how people will react to certain events happening in the market, so they know whether to buy or sell in the market. He also explained the bond market to our society. We learnt about the different types of bond investors: Pension funds, Insurance companies, Other central banks, Hedge funds, Corporations, Private investors. We went through how each investor plays a part in the bond market such as pension funds and insurance companies make commitments to monthly payments.

He proceeded to talk about what influences bonds in the bond market including: Interest rates, Inflation, Supply, Duration and Credit Worthiness. While he explained the practical part of these such as how interest rates lead to the yield on a bond increasing, he also taught us about Sentiment/Positioning. This is how 80% of all bets spreading accounts lose money due to them falling into the same pattern of buying high and selling low. This, again, is part of the human side of investment banking due to investors naturally, when things are most euphoric in the investment world, at the top of a long bull market, want to be buying and when things are most painful, at the end of bear market, these human beings are in there selling.

For those in the society who would be interested in going into this line of work were also informed on how to do that. Daniel Read let us know how he got into investment banking, after going to university and getting an internship, he left to work abroad. He worked abroad for 10 years in Hong Kong and Tokyo before returning to the UK to work for a new firm. He explained how difficult getting an internship was, however, and even if you get one you need to find the balance between showing interest, drive and desire.

Rufus (Year 12)